By: Mark Elmo Ellis

Ok, Warriors, you’ve decided to take action and begin investing.

Unfortunately, you have no idea where to start. You look at investing money like a Neanderthal looks at a computer chip. As you look at all the different investments online, your mind swirls in confusion.

Woah, trooper! You don’t have to go down that road yet.

Before you even think about that first stock pick or how many Krugerrands to buy, you need to take an important first step.

Since you’re new to this, I’m going to spoon feed you this initial step so that you’ll be off to get a good start. So if you’re serious about getting started investing, you MUST take these 2 action steps to begin. You can’t skip this because it will be the basis for your wealth creation.

So, Warrior, let us begin.

Step #1 – How to Calculate Your Net Worth

The very first thing you must do is figure out your net worth. Your net worth is everything of value that you own, minus your debts.

What you own are your assets and what you owe are your liabilities.

So, assets minus liabilities equal net worth.

Your assets are things like cars, real estate, cars, investments and anything else of value.

Your liabilities are debts that you owe. Some of the debts you have are money that’s owed on your assets.

For example, you could have a house that you’ve already paid money on. If you’ve paid $50,000 on your home, you have $50,000 in assets on your home. If you still owe $30,000 to a bank for the home, you also have that as a liability.

If you list this out it looks like this:

Original home price: $80,000

Paid (asset): $50,000

Owes (liability): $30,000

Pretty simple, eh?

Now, I know what you’re thinking. You’re thinking, “Holy tons of crap, Batman! I’m $30,000 in debt!

While that sounds pretty bad, you are better off than you think.

In the scenario above, you only owe on what you are living in. Usually, people have all kinds of bills.

Here’s a more extreme example:

Liabilities:

Car Loan: $10,000

Home: $80,000

Credit Cards: $2,500

Student Loans: $15,000

Assets:

Home Equity: $30,000

401 K Plan: $5000

Gold and Silver Holdings: $2000

Cash in Bank Account: $4,500

Total Liabilities: $107,500

Total Assets: $41,500

Liabilities minus Assets = $66,000 in Liabilities

$66,000 in today’s terms is not a hard figure to manage and reduce.

I would like to mention that you have other bills like gas, water, food, etc. that you still need to take into account. Of course, these are living expenses and you will still need to pay them.

Everything on the balance sheet you can do something about. You can reduce living expenses, but they will be there no matter what.

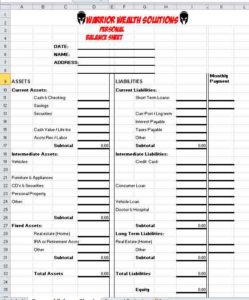

To help you get started here’s a Personal Balance Sheet you can use to get started: (Please click on image to download)

How the Net Worth Balance Sheet Gives You God-Like Powers

The reason why investors like to look at a net worth balance sheet is it gives them a 360 degree view of the battlefield.

You can immediately see where you need to focus your firepower. And that focus is usually on the easiest investment you can make: debt reduction.

Usually, the best place to reduce your debt is your home. The reason is that you’re reducing debt as the value of your property increases.

But before you do that, you need to pay down the debt that has the highest interest rate: your credit card.

Usually the interest rate on a credit card can run anywhere from 15% to almost 25%! (That is, if you’re making monthly payments.)

So doubling or even tripling down on those suckers is your biggest concern. I’m not against credit card use like some financial gurus are.

If you can use them and pay off the entire balance at the end of the month, then you don’t have to pay interest.

When my wife and I got married 36 years ago, we made a pact to never pay monthly on credit cards. If we ever got into debt enough where we couldn’t pay the card off by the end of the month, we cut up the cards.

Period, no questions asked.

In 36 years, we have never paid interest on a single card. Not only that, but we get gift cards from using them every year. We don’t even have to buy gift cards at Christmas because we get them for free.

The reason for this is a thing called “self-control”. If you don’t have self-control over a piece of plastic, then don’t get one. Plain and simple.

How to Make Your Net Worth Massive!

Now it’s time to show you troops how to sock some money away. The main thing you must do at this point is look at this process like it is a game.

Everyone complains that they don’t have enough money at the end of the month to invest. Bull! You can find money to invest, even if it’s only a few bucks.

Here’s a rule I want you to post somewhere where you can see it:

If I fail to save a dollar today, I’ll:

- Loose that dollar

- Loose the interest on that dollar

- Loose the interest on the interest on that dollar forever…

The first thing you need to do, is to cut as much spending from your budget as possible. Let’s take a look at how you can do that.

Here are some common items you could get rid of without breaking a sweat:

- Expensive cups of coffee – You can’t make it at home?

- Eating out with your friends – Pack a lunch and eat in a park.

- Junk food like candy and soda – Not nutritious and bad for your health.

- Cigarettes – Don’t get me started. You’ll save money on insurance, health care, medical & dental expenses, to name a few.

- Cable TV- You can now get 30+ channels in most states with only an antenna.

- Buying books at full price – I look at the books at the bookstore and then order them “used” on Amazon.

- Making sure you turn off the lights – Yeah, you have to watch the little things.

- Using coupons – You can save loads at the grocery store.

- Giving up childish crap like expensive video games – Man-up if you want to have a massive net worth

Let’s face it Warriors, you’re going to have to make some sacrifices if you’re going to increase your net worth.

But hey, you can make it fun if you keep track of how your finances are growing. Also, you can find lots of ways to cut back and do other things that will improve your quality of life.

For example…

- Instead of going to an expensive move once a week, go hiking.

- Instead of drinking expensive coffees from Starbutts, buy an upgrade at the store and make it at home.

- Instead of eating out, try gourmet recipes from the Internet.

- Instead of having a massive cable bill of over $100 a month, cut the cable and have antenna TV and internet services only. (You can still watch all kinds of stuff with a Roku device.

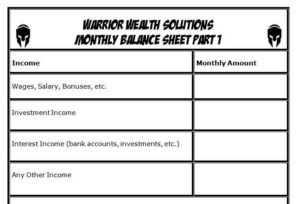

Step #2 – Use a Balance Sheet to Take Incredible Leaps in Your Finances

A balance sheet is a list of expenses and income sources. It is a vital key in helping you track your spending habits. If you can see where each dollar is going, you’ll have much better success at building your net worth.

When you list out all your monthly expenses, you can see where your money is going and how to cut back your spending.

Here are a couple of key questions you can ask yourself while looking at your monthly budget:

- Where can I cut back spending?

- Can I afford this?

- Where can I invest my money rather than spend my money?

The Warrior Wealth Solutions Balance Sheet

I have provided a detailed sheet for you to track all your expenses. It is extensive and will take you some time to fill it all out. You’ll want to work an hour or two and then take a break.

Here’s what it looks like. Click on the image below to access the sheet or on this link: Warrior Wealth Solutions Monthly Balance Sheet

The main thing is that you fill the darned thing out as accurately as possible.

Once you have this sheet completed, you’ll have an understanding of what your finances are. If you’re spending more money than what you’re taking in, look at things to cut. (The first place I’d look at is eating out and entertainment.)

Conclusion

As usual, I’m going to give you some parting advice, Warriors. If you want freedom, you have to do whatever it takes to make it happen. The thing that puts most people’s feet into concrete is the fact that they won’t take action.

If you want to start investing then taking these first steps is very important. Take the time and effort to assess where you are and figure out where you want to go.

If you take massive action and make things happen, you can achieve your dreams. Dreams of calling your own shots, traveling, or buying whatever you desire.

The only one that can take that first step is you. Why not take it right now?

A member of the Warrior Wealth Solutions Team, Mark Elmo Ellis is a copywriter focused on writing high conversion copy for professional coaches and educational organizations. Mark is also a rabid blogger. Check out his blog, ElmoCopy, and get a free copy of his 200+ page book, “Blog Profiting Secrets”. You’ll also gain access to his 20 free blogging videos where he answers a host of questions on how to start and write for your own blog. Mark’s tutorials and book are sure to help you raise the bar on your own site’s content and help you take your business to the next level.