You’re confused about how to invest, aren’t you?

You’ve got friends that have loads of investments, yet you feel like you’ve been left in the wilderness to die.

One of the problems is that there are so many bad investment choices that you can easily fall into a trap.

In this post, I’m going to show you the absolute WORST investment vehicles there are.

However…

If you bear with me to the end, I’m going to let you in on an investment secret that’ll have you banking like a boss in no-time.

So hang in there, because I’m going to give you valuable advice you can take to the bank.

All That Glitters is Not Gold

Years ago, I worked for a major jewelry retail store in Dallas, Texas. I was young and stupid, but looking back I can see there were morons in the “Lone Star State”.

Years ago, I worked for a major jewelry retail store in Dallas, Texas. I was young and stupid, but looking back I can see there were morons in the “Lone Star State”.

(I mean, if you were stupider than me you had to be a moron.)

Just to show you how brilliant I was, I worked in retail selling jewelry. It was so exciting selling products that I couldn’t afford.

Day after day, young couples would come in to the store I worked at to buy wedding rings. These kids looked like they didn’t have two dimes to scrape together.

They would look at rings that were in the $3000 + category. It was my dubious honor to help them get a line of credit so that they could sink themselves into debt.

There’s nothing quite like having a wedding with a $3000+ credit card bill as soon as you say, “I do.” (And that was just for the rings!)

One day, a jewelry wholesaler came into the store looking for the district manager. He was pulling a big case behind him on wheels and wore a big smile. I told him that the district manager was out.

That didn’t stop him from trying to make a sale.

He flipped a latch on his case and there was a mother-lode of jewelry. He had rings, solid gold bracelets, necklaces and everything in between.

“How’d you like to own this?” He pulled out a watch with diamonds lining the face of it.

“I can’t afford that.” I told him. “That would cost me a year’s salary.”

“I’ll tell you what; I’ll let you have it for $500.”

“Sorry, I still can’t afford it.” I was on a tight budget as it was, and even $500 was out of my league.

He dropped it again to $250.

I was surprised that a diamond-faced watch like that could be had for so little. I assumed that this man was hawking crap and told him, “No thanks.”

The next day as I came into to work, I was walking past the front display window of our store and I stopped dead in my tracks.

Sitting in the window was the $250 diamond-faced watch. It had a $2500 price tag on it! I was blown away. I asked the district manager if the guy had come back to the store, and he had.

I learned a valuable lesson that day: the markup on jewelry is tremendous. Not only that but if I had bought that watch and taken it immediately to a pawn shop, I would have been lucky to sell it for $75.

Jewelry is a sucky investment. If you want to spend money on your spouse, go on a nice trip, save up for a car, or find another investment.

You will lose big-time buying bling.

A House is Not a Home When it Owns You

I’m always amazed when I drive through a posh neighborhood with 5000+ square foot homes. I usually see young couples pushing expensive looking baby carriages down these streets.

There are huge SUV’s parked in their driveways, and yards look like they’re manicured.

I usually scratch my head trying to figure out how these young couples can afford these homes.

One day, I bumped into a contractor that worked in these neighborhoods; I asked him if he knew how these kids could afford these massive houses.

“Man, those people are house rich and cash poor. All their money goes toward their mortgages.” He told me.

“I’ve been inside many of them doing repair work, and these kids have very little furniture. As a matter of fact, their beds are nothing more than mattresses sitting on the floor. As for the SUV’s ― they’re leased.”

Shaking his head, he finished, “They don’t own a damn thing; the banks own it all.”

There are several things you need to know about real estate. First, it can be a great investment, but only under the right conditions.

If you’re coughing up more than 29% of your income for a mortgage payment, you’re in a bad place. Also, if you have a 30-year mortgage, you’re going to be in debt a lot longer than you can imagine.

You also need to remember that a home is not a passive investment ― it will need to be taken care of. Heating and air conditioning need to be serviced, you need termite protection, gutters need to be cleaned out, etc.

You will have to take these things into consideration when you buy a home.

The best way to own a house is to buy as cheap as you can and get a mortgage with a shorter term. One of your investment goals should be to have a house that’s paid off.

Having a house that’s paid for is pure gold.

You can use the house payment money for other investments. Not only that, but it takes a lot of financial pressure off of you if you lose a job or have other setbacks.

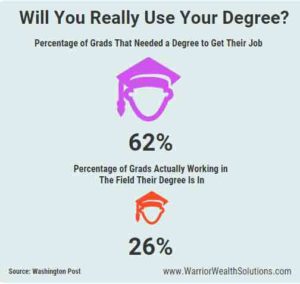

You’re Not Always Smart if You Have a College Degree

Money isn’t the only thing that gets inflated; it turns out college degrees can too.

Back in the 1960’s and ‘70’s, all you needed to have was a Bachelor’s degree to make a decent income. Now you have to have 3 Master’s and 2 PhD’s.

As cited in the Harvard Business Review article, “The Degree is Doomed”, employers want to see what you can do rather than a piece of paper that says what you can do.

So, the “pig-skin” on the wall is not always a good investment.

Just like buying a home, you have to consider how much it’s going to set you back and if the investment is really worth it.

If you spend over $70,000 on a degree and can only make $30,000 a year with it, does that sound like a good idea?

You could have easily gone to a trade school for $12,000 and made $30,000 a year, right?

I’m not anti-college because there is definitely a place for it. For example, engineering, medical, teaching, and other forms of degrees are a must.

However, if you’re going into business or marketing, do you really need a college education? Most CEO’s started out their careers in sales and did quite well. It was only after they started making big-bucks that they decided to get their degrees.

Why would they do that? To make themselves look more bonafide as they moved into executive corporate positions.

Not only that, but you must consider the long-term value of higher education. Many people have had their jobs outsourced, or eliminated in the last 20 years.

Contrast that with people that are airplane mechanics, masons, or HVAC repairmen. Those trades can be learned for a lark and the opportunity to make solid money over the long-term is excellent.

(I also want to mention the fact that you can learn more than one trade so you’ll hedge your odds against being unemployed.)

Insurance Policies Can Put You into an Early Grave

Insurance policies that have investments linked to them are a pain in the ass. The big reasons to avoid these suckers are:

Agent Commissions – There’s a good reason why agents are dying to sell you an investment-linked policy: MOOLA! They can almost make an entire year’s premium from one sale.

Low Allocation Rates ― What this means is, you can only buy investment units of mutual funds at a rate set by the insurance company.

If you buy this type of policy, you put in $6000 per year, but get to invest a mere $900 of it. Each year you get to invest more but it is insignificant to the amount you’re shelling out for the policy.

Other Fees ― There are a rash of other fees as well. There are fund management fees, administrative charges, and others that occur on an ongoing basis.

Are You a Consumer or an Investor?

At the end of the day, you have to ask yourself, “Am I a consumer or a vendor?”

If you buy a franchise to start a Fatburger restaurant, are you being a buyer or are you making an investment?

You need to ask yourself this each time you make an investment.

If you are spending money and not saving it, you are not an investor. You would be a speculator because your money is being used and unavailable.

I’ll be honest with you. The business of investing and getting returns can be rather vague.

If you go to a school that teaches guitar repair, you’re going to spend your money on the school and the tools you’ll need.

Initially, you will be out of money. But let’s say you did your homework and knew for a fact that you could make money when you graduated.

That would be an investment risk, but an educated one.

There are investments you can make that are not high risk. As you gain more experience and knowledge you can make money at.

Begin Making Money Today Investing

There are several ways you can get into investing that are low risk and require little money to get into. They can also give you a good return on your money.

Years ago, I bought gold for $300 an ounce and the price leaped up after that.

I took the left-over money I had to invest each month and bought precious metals with it. That was a low risk and high return investment ― so it can happen!

Now we have a new beast on the block called the Internet.

There are so many different ways to invest your money that it defies the imagination.

To give you an example, I’m going to show you how you can get started making money right now.

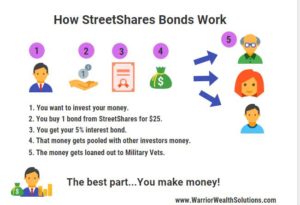

StreetShares – Your Door to a Great Investment

Here is an easy way to securely invest your money. StreetShares is the name of a company that loans money out to military veterans.

Many times, when a vet gets out of the military, he or she will need a loan to start a business. Usually, the process of getting a business loan is a long and dark road.

Banks are very tough to get a business loan from because it’s a high risk. Their chances of getting their money back and making a profit are slim.

StreetShares is a company started by two veterans. They have made the process of getting a business loan easier for military vets.

All a veteran needs to have to get a loan with Street Shares is:

- Good credit

- $100,000 in profits or be in business for 1 year

- S. citizenship or permanent resident.

Of course, they also require the veteran to provide them with personal information like a social security number, Employer’s I.D. number, etc.

The idea behind this is to provide veteran’s a way to get a business loan very easy.

How do investors make money with StreetShares?

If you are going to be a high-roller investing with Street Shares you’ll need $100,000 in net worth.

Wait!

Don’t leave this page, because there’s a way for you to get into the game for next to nothing.

StreetShares has a program for small-time investors too. You can buy into bonds that the company has for a mere $25.

And the best part? StreetShares offers a 5% return on your money.

If you’re unfamiliar with bonds, here’s how they work:

Big corporations (like the U.S. government, for example) need funds all the time. So they sell you a bond which is an agreement to pay you a certain amount of money after a specified period of time.

With StreetShares, you give them money and after that specified period of time you have your money plus the 5% interest on it.

With StreetShares, you give them money and after that specified period of time you have your money plus the 5% interest on it.

If that doesn’t seem like much, take a look at the interest rates at your average bank:

Conclusion

As you can see, there are worse ways to invest your money and good ways. Remember, you have to consider if you’re an investor or a consumer when you think about investing.

Once again, if you want a quick and simple way to make money investing, StreetShares is a good opportunity and very easy to get into.

Note: StreetShares also has loan programs for veterans. If you’re a vet and need a business loan, check out StreetShares to get the ball rolling on your dreams today.

We need commenters!

Please leave a comment below and let us know what you think of our post. We’d love to hear your views and opinions.