As a veteran, you have every right to feel proud about serving and protecting your fellow citizens. However, there is more for you to get out of your service to the country than just pride and a sense of peace. In this article you will learn how to get a VA loan.

There are several benefits that the federal government has on offer for you. We’ll examine the benefits of a VA loan.

Offered by the U.S Department of Veterans Affairs (VA), the program allows veterans in the country to secure a mortgage.

This is a great opportunity for all veterans to buy a home after they have left the service.

Before getting into the details of how veterans can secure a VA home loan, let’s try to understand the VA loan and the benefits of obtaining it.

Getting to Know the VA Loan and Its Benefits

A VA loan is provided by many lenders across the United States. However, there is only one insurer of the loan: The U.S Department of Veterans Affairs (VA).

The purpose behind the program is to allow veterans to buy a home even if their credit scores are not all that great. Eligible veterans can get a VA loan without making a down payment.

It is important is to remember that the VA does not directly offer the loan. Instead, it is an insurer of the loan in case of a default.

So, you now have a basic understanding of the VA loan but what about the benefits of applying for this loan? Following are some of the key benefits of a VA loan:

- Low interest rates

- Easier to qualify for than traditional loans

- Zero down payment

- No mortgage insurance

- Low closing costs

- High debt-to-income ratios accepted

The Eligibility Criteria and the Documents Needed for a VA Loan

As seen above, there are many benefits of applying for and securing a VA loan. So, what is the eligibility criteria for this loan?

More importantly, what documents are needed to get the loan? Firstly, you are eligible to apply for a VA loan if you meet any of the following criteria:

- Served for 90 straight days during a war

- Engaged in active service during peacetime for 181 days

- Served National Guards or Reserves for over 6 years

- Are a spouse of a service member who died in the line of duty

If you meet any of the above criteria, then you can apply for a VA loan. The documents needed to apply for the loan are as follows:

- Form DD-124

- Certificate of Eligibility

- Form 28-8937

- Form 28-1880

These documents are always needed to apply for and secure a VA loan. There are some other documents as well that may be required for obtaining the loan; these documents include:

- Government-issued ID

- Source of funds for earnest money deposit

- 2 Years’ W2’s (most recent)

- Most recent paystubs

- Purchase contract

- Tax returns if employed

If you meet the eligibility criteria and have the above-mentioned documents in order, then you can apply for a VA loan as soon as you want.

So, you’re now probably wondering, how to get approved for a VA loan?They are discussed next.

The Steps to Secure a VA Loan

If you meet the basic VA loan program requirements mentioned above, then you will now see who who qualifies for VA home loan. The following steps are involved in securing a VA loan:

1. How to Get Prequalified for a VA Home Loan

The first step in the VA loan process is pre-qualification. This means that the first thing you need to do is to get pre-qualified for the loan.

To pre-qualify you for the loan, the VA lender will ascertain your purchasing power by reviewing and verifying your income and other financials.

If the lender is satisfied with your income and other financials, they will pre-approve you for the loan. It’s that simple!

2. Offer

Once you are pre-approved for the loan and have found a VA approved home, you need to sit with the seller and negotiate a contract. This is where you will need to make an offer for the home.

3. VA Appraisal and Underwriting

Once you have sealed a contract with the seller, the lender will start a VA property appraisal.

The process will also involve underwriters who will review the finalized appraisal along with your income and financial documents.

If everything meets the requirements, you will be moved to the loan closing stage.

4. Closing

The fourth and final step in securing a VA loan is closing. To close the deal, you will need to sign all kinds of paperwork and legal documents.

Once that is done, you will be handed the keys to your new home. Congratulations!

The Minimum Credit Score Required by VA Lenders

When approving applications for loans, a VA lender keeps a credit score benchmark that applicants have to meet.

Veterans who have credit scores lower than the lender’s benchmark are usually rejected.

While the credit score benchmark or the minimum credit score varies from lender to lender, 580 is typically the minimum credit score that VA-approved lenders look for to approve an applicant.

Many veterans think that 630 is the ideal credit score.

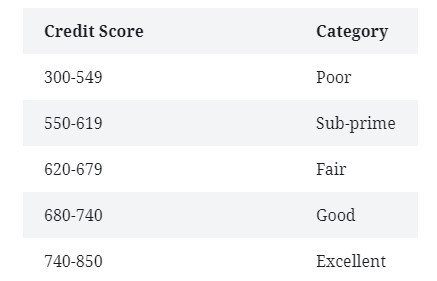

However, this is not true. Following the table below shows the different credit scores and how they are categorized.

The table will give you a fair idea of where the credit score of 580 ranks in the credit score hierarchy:

If you meet this minimum credit score requirement and other criteria, you now know how to get approved for a VA home loan.

If you want to find out more about how you can increase your chances of VA loan qualifications then I’ll be glad to connect you to one of our veteran resources like Debt Does Deals.

2 Comments

Chris Jackson

Let me know if you enjoyed the article and would like more information pertaining to this topic! Drop your comments here and let us know how we can improve or what areas you would like to know more about!

John Richardson

Exactly what I was searching for, appreciate it for putting up.